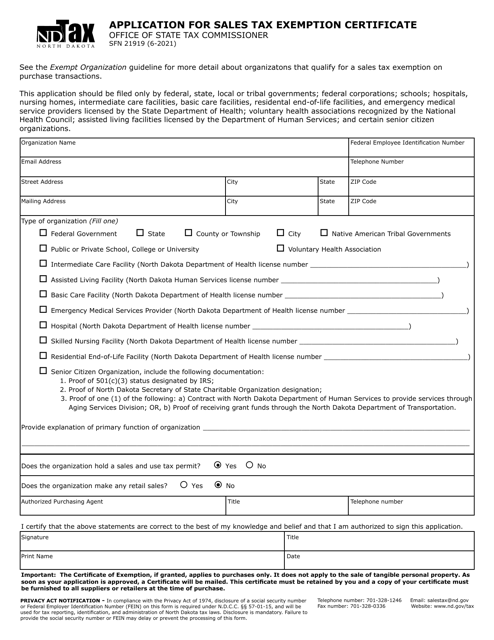

nd sales tax exemption form

Purchasers are responsible for knowing if they qualify to. A manufacturers franchise to sell the new vehicle purchased the dealer must pay sales tax and the resale exemption is invalid.

Most states with a sales tax have a farm machinery and equipment exemption for products used for agricultural production.

. Varying state processes for obtaining sales tax exemption can make it challenging to determine where. North Dakota residents to pay use tax on goods purchased tax free from out-of-state sellers. Streamlined Sales Tax Agreement Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board.

Ingredient or component exemption the Buyer cannot use this form and must provide to the. The tax account number is assigned by the Nueces County Appraisal District and is used to help identify each piece of property. Entitled to claim a resale sales tax exemption or exclusion the Buyer should complete the certificate and send it to the Seller at the.

If you have a North Dakota Sales Tax Permit please use ND TAP to submit any sales and use tax you owe when you file your return. In individual states or performing proper due diligence to determine whether or not the organization qualifies for exemption in the states that accept this form. HOMESTEAD EXEMPTION up to 50000.

What is a tax account number and what do you mean by a legal description. The Office of the State Tax Commissioner oversees the valuation of real property through a sales ratio analysis which determines if a jurisdiction is maintaining their property valuations at market. 625 on a purchase that would have been taxed in New Jersey the purchaser owes Use Tax on the difference between the two rates.

New computer edits have been added that will flag suspicious returns. ND FL7 OH22 GA8 OK23 HI49 PA24 ID10 25RI IL411 SC IA SD26 KS12 27TN KY13 TX28 ME14 UT MD15 VT29 MI16 WA30. Form ST-108E State Form 48841 R4 3-08 Calculation Of Purchase Price Trade in Information.

Cass County Sales Tax. Property Tax Calculator. Amendment Rights See item 30 National Guard Association.

Not all states allow all exemptions listed on this form. The seller may be required to provide. Form NDW-M - Exemption from Withholding for a Qualifying Spouse of a US.

Who should use this form. Form 306 - Income Tax Withholding Return. Most states accept the Uniform Sales Use Tax Certificate as a reseal form but some states require special ones.

If you do not have any of the ID numbers listed in 1 thru 4. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that would otherwise be due tax on this sale. Vehicles or watercraft not to be licensed for use which are eligible for a repossession title.

No credit is allowed for Sales Tax paid to a foreign country. Find your state in the list below and download the corresponding tax exemption form. Every employerwithholding agent that has an employee earning wages in South Carolina and who is required to file a return or deposit with the IRS must make a return or deposit to the SCDOR for any taxes that have been withheld for state purposes.

You are not required to list an ID number for the following. In some states these items are still taxed but at a lower rate. Form 13-88 in this packet Page C.

Form 301-EF - ACH Credit Authorization. Send the completed form to the seller and keep a copy for your records. Streamlined Sales and Use Tax Agreement Certificate of Exemption E-595E This is a multi-state form.

Not all states allow all exemptions listed on this form. Streamlined Sales Tax Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board. All organizations may file a Tax Exemption Claim Form with a Redemption of Waiver Form if the property was owned and operated by the non- profit between January 1 st and March 1 st of the current tax year.

Diplomatic Sales Tax Exemption Cards The Departments Office of Foreign Missions OFM issues diplomatic tax exemption cards to eligible foreign missions and their accredited members and dependents on the basis of international law and reciprocity. Withholding Tax is taken out of taxpayer wages to go towards the taxpayers total yearly income tax liability. These returns will be reviewed by.

Canadas Outdoor Farm Show. The Redemption of Waiver window is between March 2 nd and September 30 th of the current tax year. Sep 13 Sep 15.

Sales Tax is paid to another state including ales Tax paid to a city county or other S jurisdiction within a state at a total rate less than 6. A person who on January 1 has legal title or beneficial title in equity to real property in the State of Florida and who in good faith makes the property his or her permanent residence is eligible. 42 nd Street 18 th Fl.

Attach the Application for Sales Tax Exemption by Motion Picture or Television Production Companies. ND Sales Tax. ND 58078 Find us on a map.

Most states also offer an exemption from sales tax for occasional casual or isolated sales such as a yard or garage sale or estate sale. This is a multi-state form. County Park at Brewer Lake.

California Download form Colorado Download form Idaho. All applicants must file an application in-office for homestead exemption. These cards facilitate the United States in honoring its host country obligations under the Vienna Convention on Diplomatic.

All other states require an ID number as listed in 1 2 or 3. KY ND NJ OK RI SD TN UT WA WY. The One Time Remittance form is for one-time sales and use tax remittance only.

Property Tax Calculator. Completed OTC Application for 100 Disabled Veteran Household Member Exemption Card Form 13-55 signed. More Thorough Scrutiny of ReturnsIn a continuing effort to ensure individuals and businesses comply with Georgias tax statutes and to level the playing field for all taxpayers the Department of Revenue has established a new system to more thoroughly review returns.

Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically.

Which States Require Sales Tax On Software As A Service Taxvalet

Saas Sales Tax And What You Need To Know 2020 Profitwell

Arizona Sales Tax Audit Guide For Businesses

Pdf An Emprical Assessment Of The Impact Of E Commerce On Value Added Tax Revenue Generation In Nigeria

Form Sfn21919 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Certificate North Dakota Templateroller

Which Organizations Are Exempt From Sales Tax Sales Tax Institute

Which States Require Sales Tax On Software As A Service Taxvalet

What You Should Know About Same Sex Marriage Tax Benefits

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

Pdf Analytical Review Of Direct Taxation In India

2022 Tax Free Weekend In Florida For School Supplies July 25 To August 7

Form Sfn21919 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Certificate North Dakota Templateroller

Putin Ties Ukraine Grain Flow To Sanctions Relief Macron And Scholz Urge Serious Peace Effort

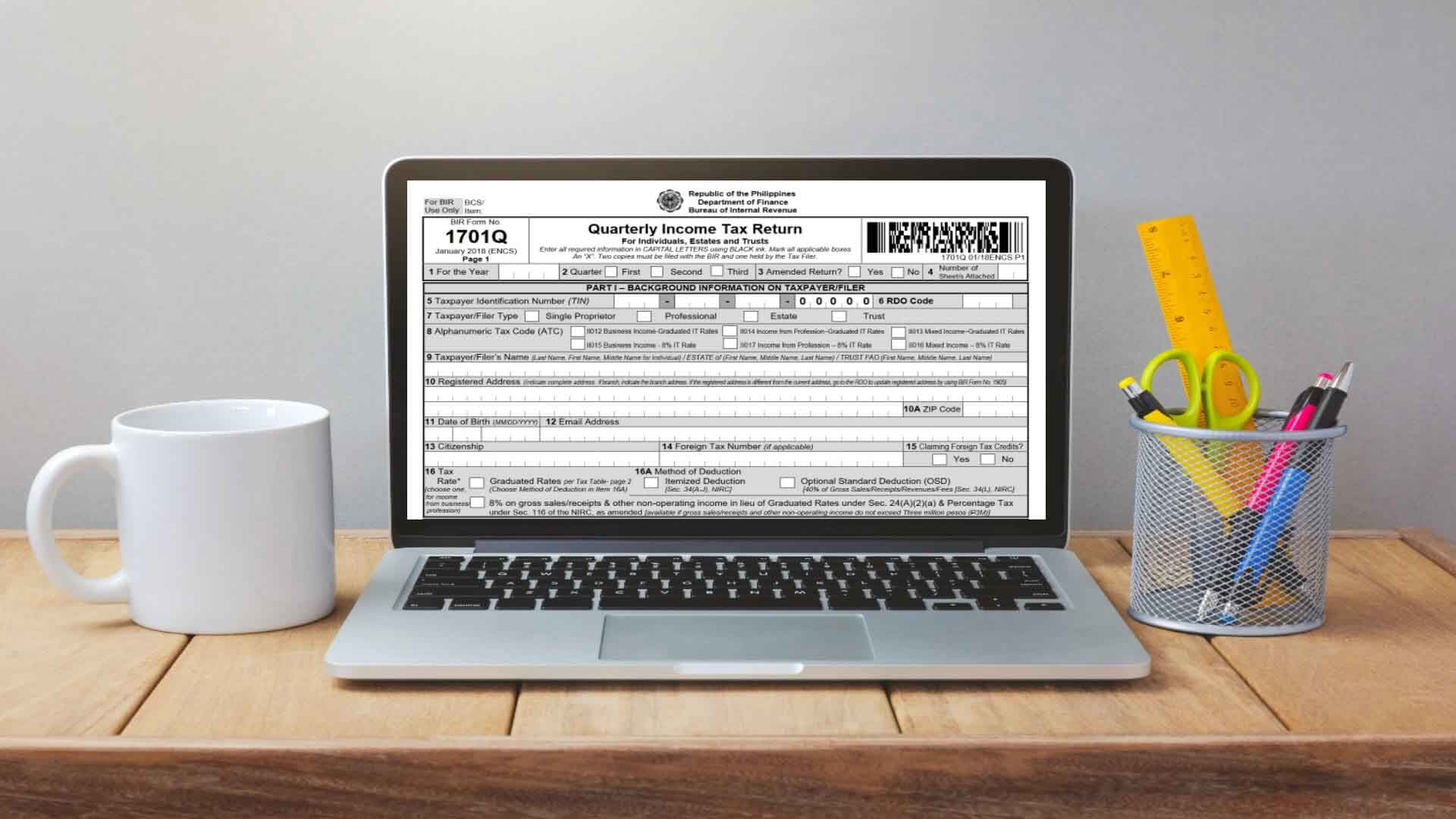

Bir Form 1701q Quarterly Income Tax Return

Sales Tax By State Non Taxable Items Taxjar

Pdf Tax Systems And Tax Harmonisation In The East African Community Eac